Consultants are wary of equities as markets continue to push ever upwards

Nvidia’s share price growth, as part of the artificial intelligence boom, has powered the strong performance of US markets in recent years (An Rong Xu/Bloomberg)

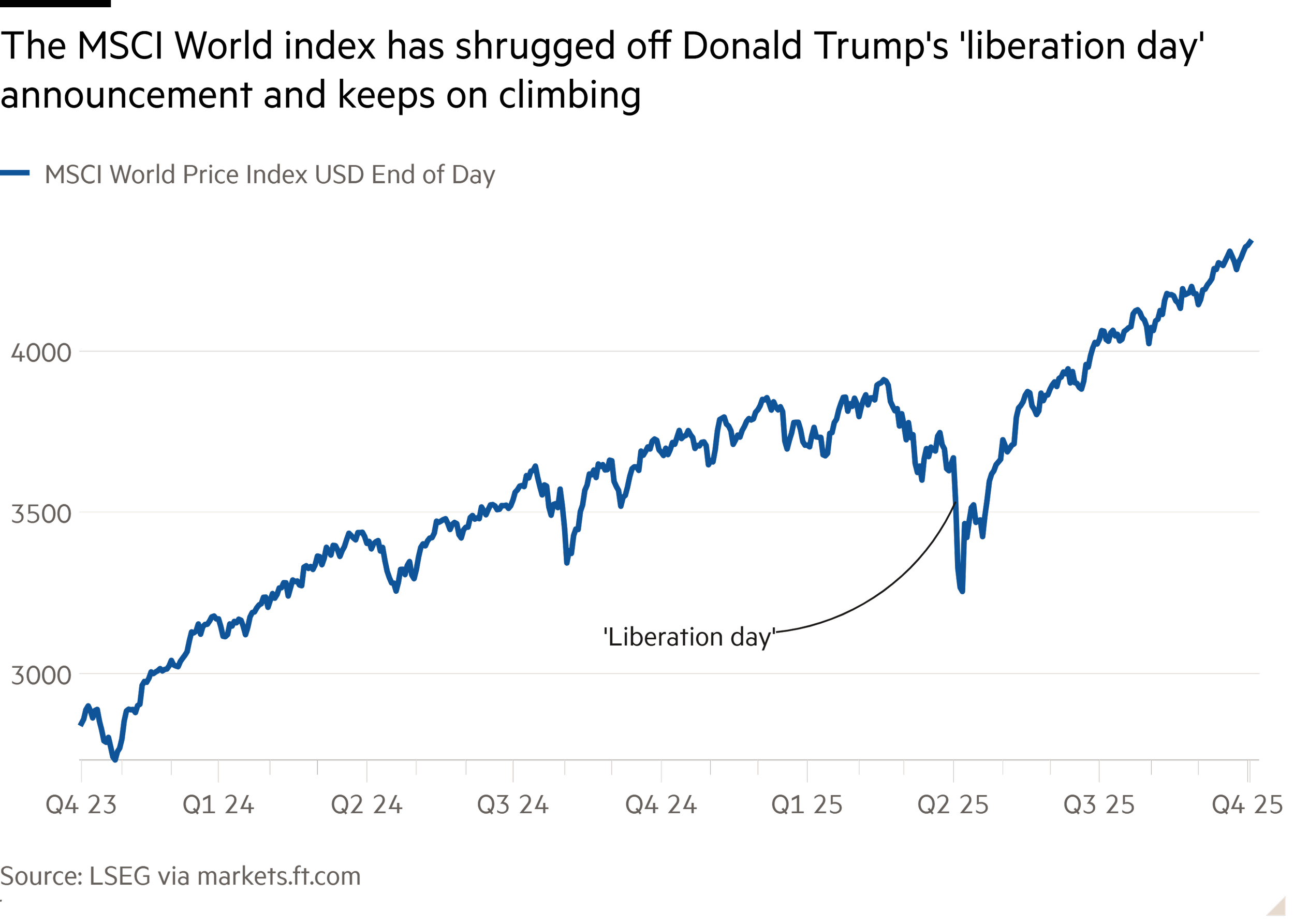

One of the big challenges facing an investor - any investor - at the moment is what to make of valuations.

Are we in an AI-induced bubble which is pushing global equity markets upwards and will pop any day now, or are the values behind companies like Nvidia actually realistic?

Well this week we talk to some of the people who have a key role in deciding how asset owners act: consultants. Do they agree with each other, or does their advice differ?

Isio, for one, is the most bearish towards global equities, holding an outright negative position, because of soaring valuations and a time of geopolitical risk.

Chief investment officer Barry Jones said: “Our clients are seeking less obvious areas to invest their capital where valuations remain attractive.”

He gave asset-backed securities and private investment grade lending as two examples of this.

“Many clients are holding dry powder in liquid short-dated assets waiting for a better market to deploy capital into,” Jones said.

The other consultants we spoke to were cautious but neutral on equities.

LCP said there was “lots of uncertainty” surrounding Trump’s trade war.

They said: “Considering the volatile macro environment, worries over US fiscal sustainability and policy, equity valuations are expensive versus recent history.”

The sectors where LCP is most positive are infrastructure and property - as well as protection strategies.

WTW acknowledges valuations are high but doesn’t think they are necessarily unfounded.

Tessa Mann, multi-asset strategy director, said: “Over the medium term, we expect high valuations to be supported (and balanced out) by a revolution in technological innovation – as AI proliferates through the broader economy and a wider set of companies.”

WTW is currently overweight UK government bonds because they expect interest rates to fall.

Rupert Watson, Mercer’s head of asset allocation, said there were certainly “bubble-like characteristics” to markets at the moment but he conceded valuations may be justified.

He said: “In terms of what AI will achieve over the next 10 years, it is still pretty early days. There are obvious near-term applications.

“There is not broad-based use by business and businesses themselves are looking into how it might help them, but the jury is still out.”